While the Cloud and its impact on the technology industry is written about frequently, often overlooked is its impact on the Professional Services (PS) businesses of technology companies. Traditionally representing 20 percent or more of software companies’ total revenue, PS has been a key contributor to financial performance as well as a key service to assist customers in adopting, integrating, and implementing software technology and updated business processes. In the world of the cloud, the role of PS is increasingly playing an integral role in defining the customer experience and driving overall enterprise growth.

How Does the Cloud World Impact PS Businesses?

Declining Demand for Traditional Services

As more standardized, cloud-based applications are adopted, there is increasing pressure for faster and cheaper implementation services. In addition, free upgrades performed centrally by cloud software vendors will increase pressure for legacy software providers to reduce upgrade fees to remain competitive with new Software-as-a-Service (SaaS (News ![]() - Alert)) entrants, or simply to deal with customer demand for lower (and more predictable) implementation costs. Because implementation and upgrade services have long accounted for the lion’s share of PS offered by technology-led companies, revenues and margins will face significant pressures in the cloud world.

- Alert)) entrants, or simply to deal with customer demand for lower (and more predictable) implementation costs. Because implementation and upgrade services have long accounted for the lion’s share of PS offered by technology-led companies, revenues and margins will face significant pressures in the cloud world.

The impact of these dynamics can already be seen across the technology industry. For example, in the enterprise SW segment, PS attach rate (defined as services bookings divided by SW license bookings) has declined from 3.2x in 2010 to 2.6x in 2014. While a 0.6x decline may not seem material, it translates into $150 Billion of PS opportunity no longer available to the market. In light of increasing cloud adoption, industry analysts predict the attach rate will continue to decline to 2.1x by 2018.

In addition, one can see these impacts begin to manifest in SW company financials as well. As illustrated in the figures below, we can see this pressure impacting PS share of total revenue for bellwether SW providers (i.e., SAP, Oracle) and the pure-play SaaS PS revenue growth and margins (e.g., Workday, NetSuite (News - Alert)) relative to legacy software providers. Despite significant growth, the SaaS players are yielding lower PS margins than those of the shrinking legacy PS businesses.

Increased Focus on Customer Retention and Adoption

As pricing models shift to subscription-based, recurring revenue models, there is an increased focus on existing customers. From a retention perspective, attention must be paid to keeping customers satisfied with the technology so that they stick with it, despite lower switching costs. From an adoption perspective, getting customers to buy more and increase recurring revenue is paramount. PS resources typically are engaged with customers post initial sale, which positions them well to influence both retention and adoption.

Adapting to the Cloud World

As the traditional rules and metrics for PS success are changing in the cloud world, technology executives have the opportunity to redefine the role of PS in this new world. To “win” in this world, PS executives need to address five key considerations as they adapt to the cloud.

Redefining Success in Light of Changing Economics

While PS organizations have long been key to driving customer satisfaction, the key success metrics for PS organizations have historically been centered on revenue and cost drivers — utilization, bill rates, and billable headcount. There are a number of new customer-oriented metrics that should be added to every PS dashboard and considered in compensation models in the cloud world. These key metrics include customer satisfaction measures, retention, and number of “go-lives.” In adopting these new metrics of success, both legacy and pure-play SaaS companies will need to resist the temptation to completely abandon the old metrics. For example, utilization is still key to capacity planning, scheduling, and ultimately, driving customer success.

Optimizing Implementations in the Face of Increasing Pressures

PS organizations also need to respond to the pressure for faster, cheaper implementations with innovation and a focus on increased efficiency in delivery. Customers will increasingly be looking for automation and pre-configured workflow/process solutions, and PS organizations will need to stay on their toes and collaborate with engineering teams to continually optimize their implementations. PS teams are tackling this in a number of ways, ranging from defining accelerated project management/implementation methodologies to setting up internal asset repositories of code snippets, delivery templates, etc. for efficiency, reuse, and consistency.

Building and Managing Partnerships that Last

Historically, alliances and partnerships have been centered on the initial customer deployment — selling and implementing the product. However, in a world where the vendor is responsible for ongoing management of the cloud technology and there is a recurring revenue stream (vs. a large up-front payment), partnering relationships will need to evolve. Technology companies must be careful to protect the customer relationship as joint service delivery continues over a much longer horizon, likely under a different commercial arrangement.

Developing New Pre- and Post-implementation Offers

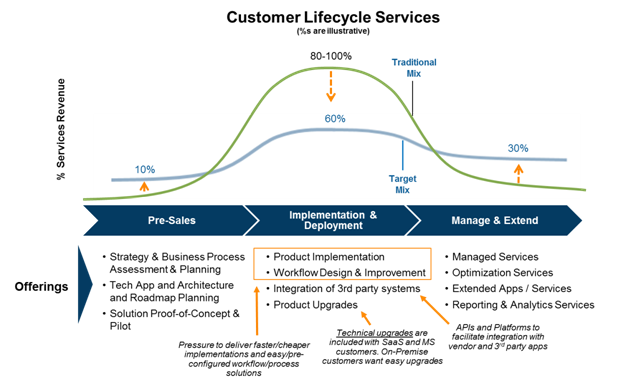

As bread-and-butter services face demand pressure, PS organizations need to extend their traditional service boundaries and develop more compelling pre- and post-implementation offerings. As depicted by the illustrative example below, cloud will increasingly put pressure on traditional “Implementation & Deployment” Services, which have historically generated 80-100 percent of Services revenue. Adding pre- and post-implementation offers can help offset that pressure by flattening the curve. Companies are taking a fresh look at their services portfolios with renewed focus on non-implementation offers, including managed services, optimization offers (e.g., system health checks, performance tuning), and architecture/roadmap planning.

Enabling Customer Success

As PS organizations think through changes in metrics, service delivery, go-to-market strategies, and offering portfolios, there are also some organizational structure changes that should be considered. To change the culture and DNA of a PS organization to one that is more customer-centric, we have seen PS groups either re-brand themselves as Customer Success organizations; merge units with Customer Support groups under a Customer Success umbrella; or spin off dedicated resources whose sole focus is tracking and addressing adoption and retention. Companies are implementing a range of Customer Success operating models and experimenting with different ways to fund associated investments. Whatever the approach, technology executives must design and implement a Customer Success approach that considers and leverages Professional Services in terms of roles, structure, offerings, and customer insight.

Seizing the Identity Opportunity

The cloud world presents an exciting and rapidly changing new landscape for PS organizations in technology companies. Recognizing the shift in demand and focus areas for PS businesses and adapting to these changes across the five categories summarized above will require a significant amount of ongoing effort. PS Executives can quickly get lost amidst all of this change, but those who think through their strategies upfront can turn this market shift into an opportunity to redefine their PS identity instead of losing it.

About the Authors: Neil Jain, a partner at Waterstone Management Group has more than 15 years of experience formulating growth strategies and improving operations for companies in the software, hardware and telecom industries. Claire O’Neill, a principal at Waterstone has acted in a number of advisory roles for clients, including providing financial advisory services, developing new product offerings and business planning in a range of industries, including telecommunications, enterprise software, and consumer technology services.

Edited by Dominick Sorrentino